In December 2017 when Cboe became the first exchange market to offer derivative crypto options, Bitcoin and its digital currency counterparts were traded at the nosebleed (severe) level. Now, crypto winter has lasted more than a year. When Bitcoin futures are launched, the hope is to play an important role in legitimizing crypto assets, driving demand and providing less risky ways for new investors - both retail and institutional - to participate. Is the Cboe suspension against Bitcoin futures products the beginning of cryptocurrency graduation?

Ryan Radloff, CEO of CoinShares believes this contract does not mean much to the larger crypto market infrastructure. "We are not worried about losing them," he said. He believes there will be no real impact.

For one thing, rivals the Chicago Mercantile Exchange (CME) will continue to trade Bitcoin futures. Also, Radloff notes:

"One of the 'industrial' cases for the BTC futures contract, at least in the crypto community, is to hedge income from Bitcoin mining. In the case of a CBOE cash settlement contract, the risk of getting a different maturity price from the one actually available on the market is too high to use it as an efficient hedge, so physical delivery wins every time. "

Laurent Kssis, managing director of the XBT Provider summed up:

"In the race for more transparent, professional-grade products with a mechanism for efficient price discovery and greater liquidity, Cboe seems to be giving the market to CME."

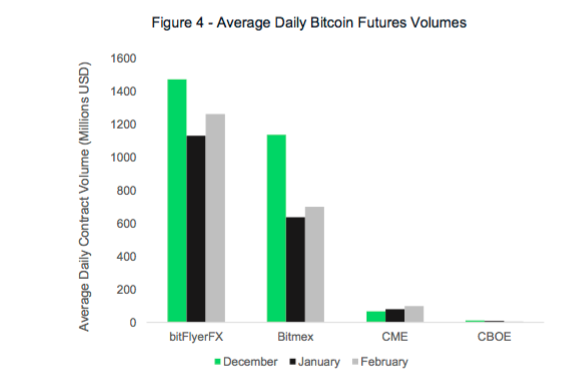

Of course, part of the problem for Bitcoin Cboe futures products is the lack of trading volume. According to CryptoCompare, from January to February 2019 Cboe volume drops by around 31% while the CME daily average increases by more than 23%.

Average Daily Bitcoin Futures Volumes

Courtesy: CryptoCompare

Some of this could be because the margin requirement for BTC futures trading at CME is 35% while it is 40% in Cboe to calculate BTC volatility.

Kssis speculates that low volume costs must exceed revenue benefits given the decline in basic asset prices.

"On the professional side, market makers prefer to hedge futures contracts using completed 'physical' contracts to reduce the risk of settlement price manipulation. With cash settlement contracts, settlement prices are never really efficient at maturity. As a result, it would appear that the buyer of this contract is only a speculator, using leverage offers.

After the long-awaited physical contract came to the market, I think most contracts that are settled in cash lose their appeal because the market will usually choose one delta vehicle that is more efficient and professional when faced with opportunities. "

Some crypto market players are disappointed, but recognize that suspension is more related to business models than asset class failures. En Hui Ong, head of business development at Zilliqa, the public blockchain platform, said:

"Although some are worried that the announcement is a sign of waning institutional interest, it is actually a matter of competition and convenience. CME competitors have their own Bitcoin futures product, with a 1 Cboe contract equal to 1 Bitcoin (BTC) and 1 CME contract equal to 5 BTC, this indicates that CME has more competitive and attractive products. "

In addition, he explained, regarding the settlement, Cboe also announced that it would only take the price of the Gemini auction cryptocurrency exchange. Single source prices open opportunities for price manipulation, which leads to greater risk.

Instead, CME has taken a far more measurable approach, using prices from several exchanges while improving its ownership process to reduce the potential for price manipulation. "Thus," noted Ong, "Cboe announcements should not be considered as a reflection of the state of institutional interest in cryptocurrency. They only have products that fail to gain market share."