I think this material will be very useful for all traders, whatever trading techniques are used, especially scalper and intraday traders.

Immediately, so here's how, Ed Ponsi uses 4 Exponential Moving Average (EMA), namely EMA 10, EMA 20, EMA 50, and EMA 200. this is what it looks like:

EMA 10 :

whiteEMA 20 :

blueEMA 50 :

yellowEMA 200:

redThe concept is Ed Ponsi, so a trend is called healthy WHEN prices move above or around EMA 10 and do not touch the EMA 20.50,200 for a trend up, if the trend down remains reversed.

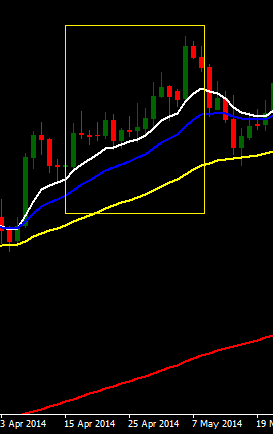

This trend up is healthy according to Ed Ponsi:

Bearish candle which after coming out of the yellow box is no longer a healthy trend because the candle has interacted with EMA 20

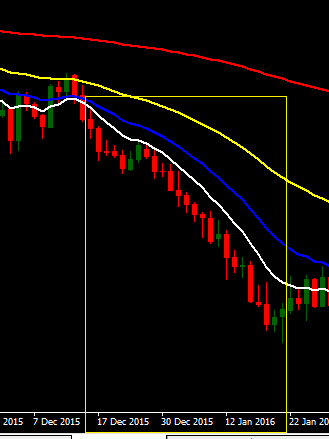

This healthy down trend according to Ed Ponsi:

Candle before the yellow box, the price is below all EMAs, but he still has interaction with 20 EMAs so it hasn't been said to be healthy. while the candle after the yellow box is already unhealthy because there is already an interaction with EMA 20

===================

So I repeat again,

healthy up trend, when prices are rising, all EMA leads upward, there are no EMAs that interact with each other (crossing, or even touch a little), and prices only move above or around EMA 10, prices also do not interact with the 3 EMA below it.

healthy down trend, when prices are down, all EMAs go down, there are no EMAs that interact with each other (crossing, or even touch a little), and prices only move below or around EMA 10, prices also do not interact with the 3 EMAs above.

How to use it?

Install 4 EMAs on a daily basis for trading on H1, or pair 4 EMAs on H4 to trade on M15.

Put the 4 EMAs on a daily basis, if there is a healthy trend, for example a healthy trend up, then down at H1, and ONLY look for buy opportunities. sell stay behind. If the trend is not healthy, yes no trade.

How to entry ??

What I'm sharing is not an entry strategy, but a way of filtering trends. So the steps are like this, for example trade using H1, yes, put 4 EMA on daily, if for example there is a healthy trend, healthy down trend for example, so already that day just thinking of looking for sell. How to determine the sell? free, your sakarep

may you use indi A, indi B, indi C, candlestick, whatever is free, the important thing is Sell only.

So, hopefully it can be useful especially for friends who might still be abstract how to determine the trend, because the old adage on Wall Street always says, Trend is our friend.

Linkback: https://www.forex.zone/trading-systems/10/filtering-trend-with-ed-ponsi/3032/